Each year, I pull together the biggest tech trends and events for the last year. Originally, this was a tribute to the amazing team that I worked with at Reed for their hard work over the year. Now, it’s tending towards an obsession. Part Mary Meeker, part Black Mirror and a sprinkle of Rude Tube, This summary spares you the the complete version of 200 slides, and 90 minutes worth of me talking…

The Global Economy

I’m no economist, but I do like to start my descent into the world of tech from orbit. The backdrop set by the global economy can help bring the movements of the tech giants and savvy investors into sharp relief.

It’s been a long time since the financial crisis of 2007 and there’s no denying we’re a long way into a bull market. Since the grass roots of 2009-10, economic indicators in the US, EU and the UK have all been growing in strength. This has been great for investors and good news for startups, but some signs start to indicate we’re in for a change of weather.

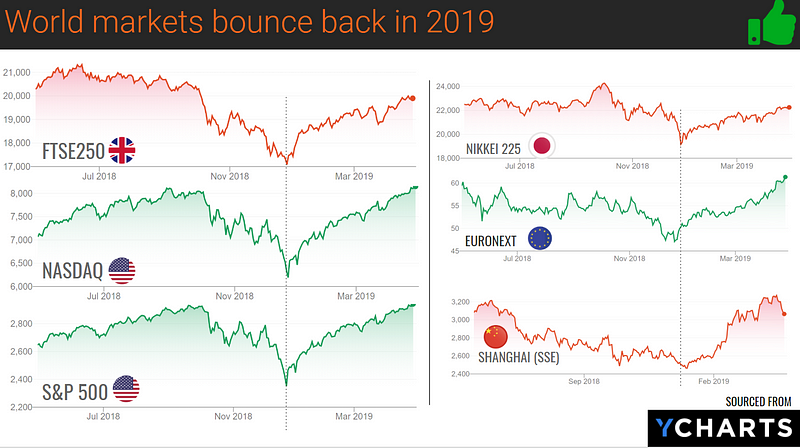

Over the last year, global stock markets have been generally strong, taking a big hit over Christmas. Still, they weathered a lot of uncertainty over the period of the US government shutdown, with a strong resurgence through 2019 to date.

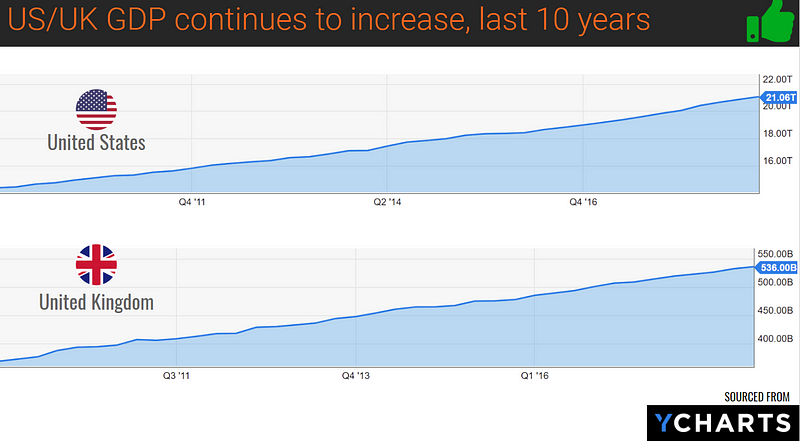

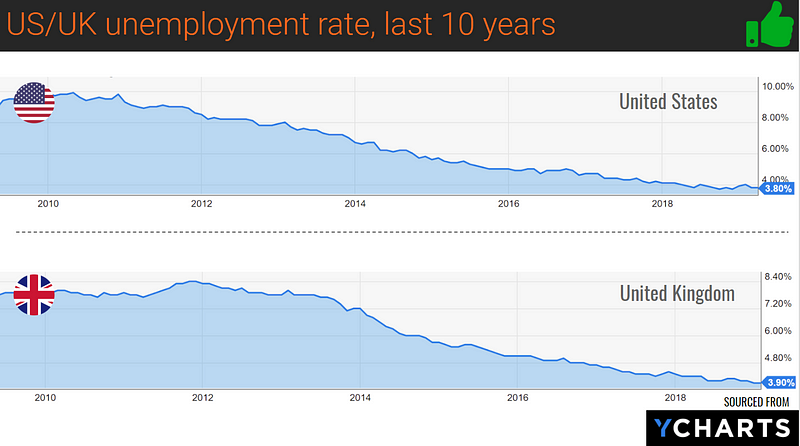

US and UK gross domestic product (a strong indicator of economic performance) has continued to grow over the last decade. Unemployment rates, clearly a massive financial and psychological indicator of economic health, continue to fall in both the UK and US.

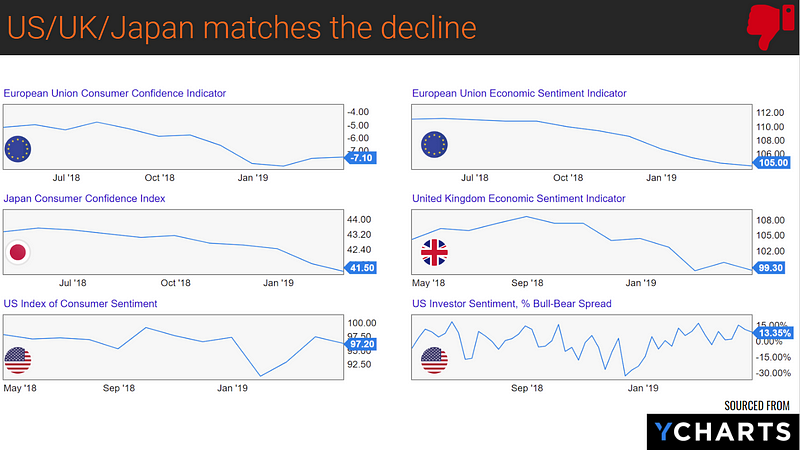

However, this might be the end of the good news. Consumer confidence, often a leading indicator of how the economy will perform, is starting to fall in the UK, US, Europe and Japan.

Meanwhile, consumer and business debt in the UK and US is growing to record highs as individuals and businesses take on more loans. This adds fragility back into the booming system.

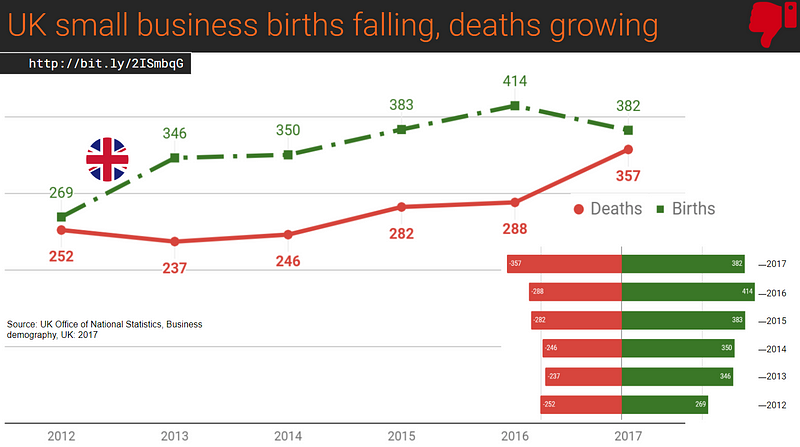

In the UK, the Office of National Statistics reports that the number of businesses ‘dying’ has now risen to almost the same level as those being ‘born’

With wage growth and the number of jobs being created by small businesses falling in the US, the picture of rude health from many indicators is tempered by some warning signs of trouble ahead.

However, while analysts in January went on record with as high as a 50% probability for recession in 2019, many of those same soothsayers have dropped this to as low as 10%. Importantly for tech, and as we’ll see later, this hasn’t yet impacted record levels of venture capital investment.

Unicorns and Tech Giants

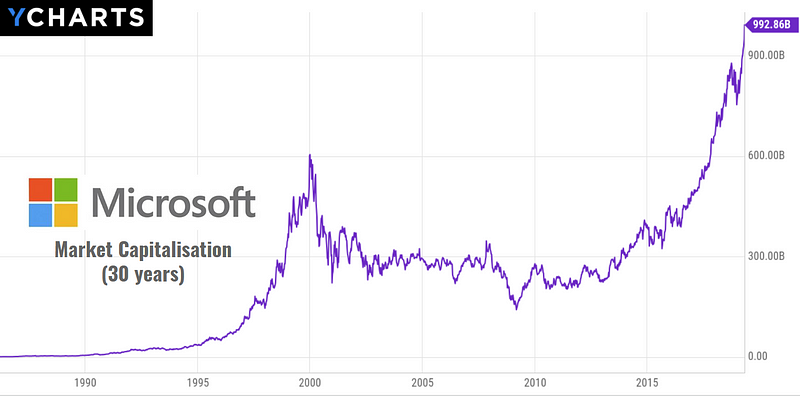

Before going any further, let me take this point to nominate Satya Nadella as CEO of the last decade with the incredible advances made by his firm. Microsoft have now deservedly joined the Rainbow Unicorn ranks (what else do you call a company worth over a trillion dollars in market cap?)

Microsoft’s resurgence from the Ballmer doldrums speaks volumes about Nadella’s leadership and quality of the teams at Microsoft. Not only have they made Azure a solid contender against Amazon AWS, but they continue to make insightful and intelligent investments, like the acquisition of Github (in Oct ‘18).

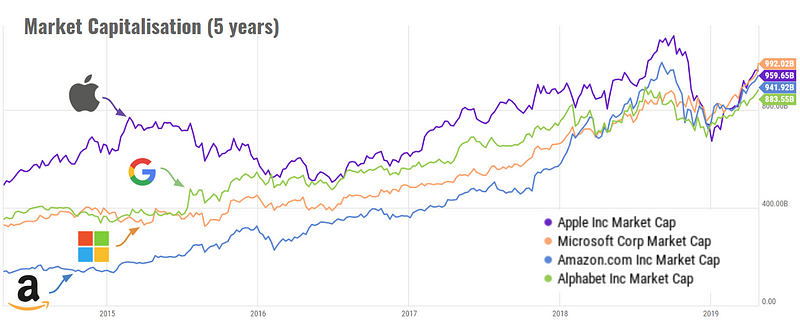

Another seismic shift has been the shattering of the FAANG (Facebook/Apple/Amazon/Netflix/Google) portfolio. It would now be much more reasonable to consider this yet another MAGA.

These four tech giants each command around $1tn market capitalisation, tussling for control of sometimes overlapping sectors.

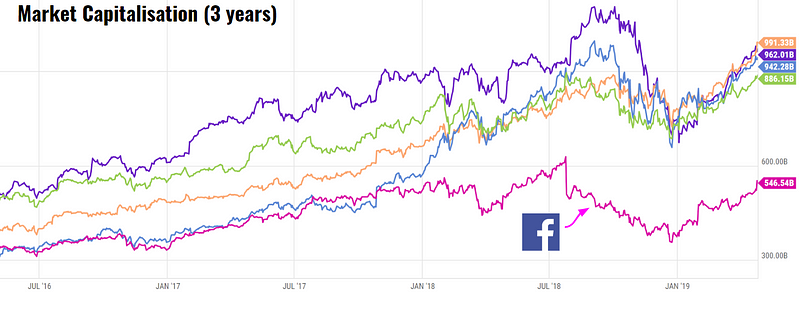

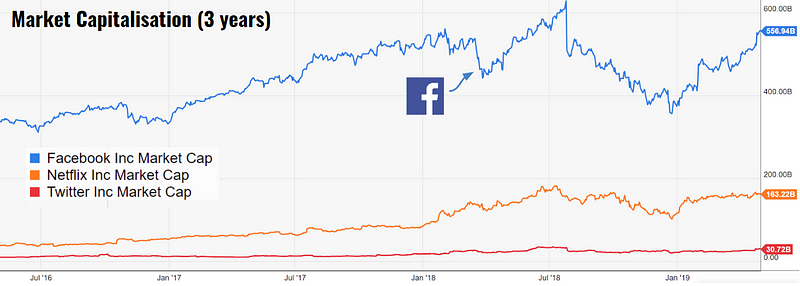

But where, then, is our old friend Facebook? It seems as if the other four may have moved on, with the projections looking very different to July 2018.

It’s been a pretty dreadful year for Facebook, with revelations of their security and lack of regard for customer data, as well as the questionable ethics demonstrated by Zuckerberg in emails disclosed by the UK government.

It’s now more reasonable to look at Facebook as the leader of a secondary pack, alongside Twitter and Netflix.

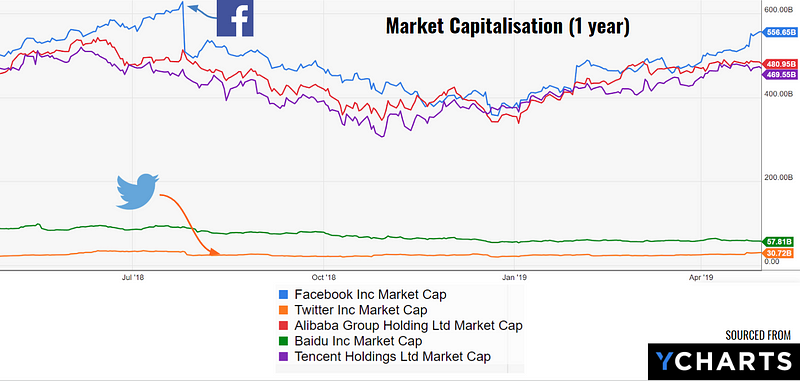

Or perhaps, even more correctly, we can start to compare the US giants against their hard-charging Chinese contemporaries

If one thing can be safely predicted for the 2019/2020 version of this deck, it’s that Chinese firms will continue to shadow, and perhaps overtake, the growth of the US giants.

Startups, investments and exits

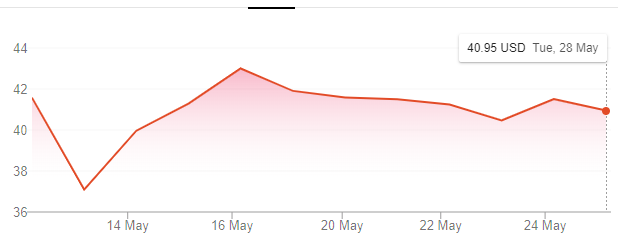

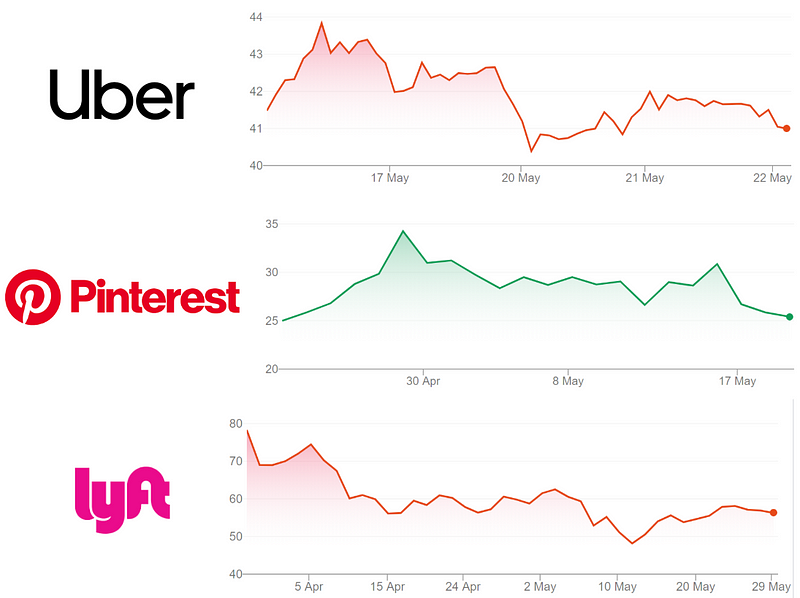

Uber. This graph:

Perhaps the most disappointing IPO of all time, if only for the hype rather than any rational hope of commercial success. Perhaps the Lyft IPO served to muddy the waters for Uber, or they simply waited too long to list, but this stock market debutant was a fly in the ointment of venture success. Fellow IPOers from the same cohort, Lyft and Pinterest failed to impress, but Uber was unquestionably the most surprising after last year’s gangbusters listings (2018 IPOs like Anaplan, Docusign and Zuora were up 30–40% after trading, compared with Uber’s 7.6% fall).

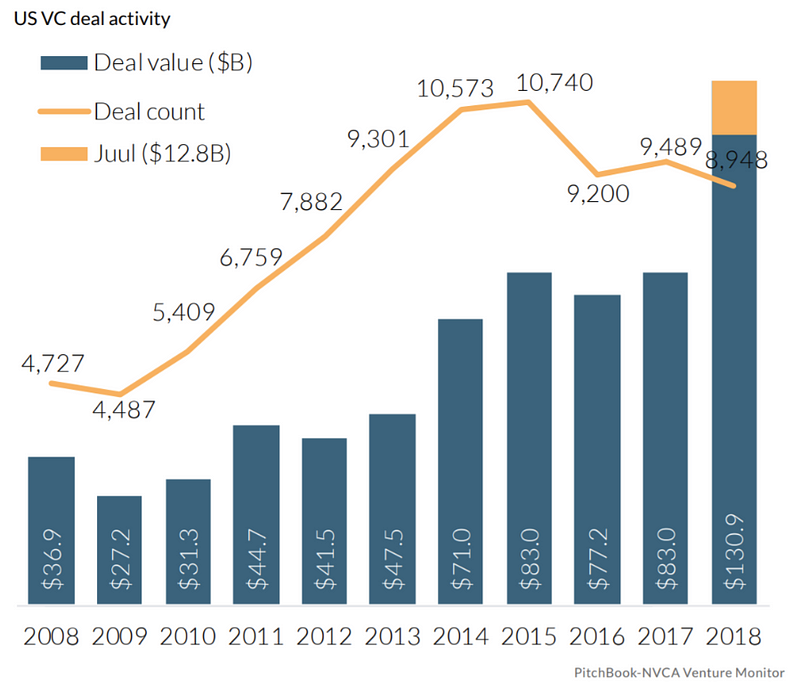

Despite these disappointing exits, Pitchbook reports that we’re currently surfing a bigger wave of VC investments than the original dotcom-boom with aggregate capital invested topping $130 billion, surpassing the $105bn recorded in 2000.

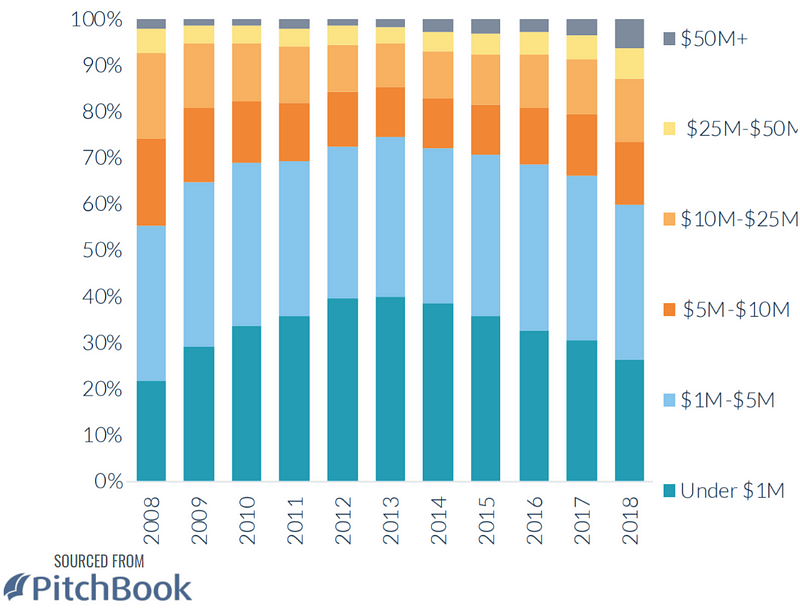

Against these massive numbers, we’re also seeing a notable trend in the type of investments, following a precedent set in the early ‘teens. Back then, as now, the number of venture deals as a whole is falling but this is offset by the average investment being larger than before. Pitchbook again show how this looks, with the number of ‘mega’ rounds of over $50m increasing steadily since 2012, to a record in 2018.

This pattern half a decade ago was down to the growing maturity of the mobile app market. Where once investors would hurl money, willy-nilly, at any company with a mobile app, growing experience in the sector brought a similar pattern of fewer, larger investments. It seems that the same maturity is now being demonstrated by 2019’s investors.

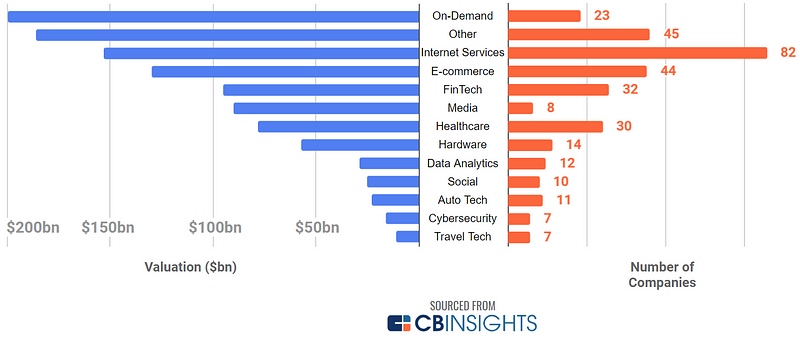

This market maturity is also reflected in the valuations of venture-backed firms. During 2018, nearly 100 companies became unicorns in Europe alone (a unicorn in startup terms is usually defined as a company with a valuation of over $1bn/£1bn/€1bn). Based on CBInsights data, the ranks of the global unicorns are varied with the greatest valuation for ‘on-demand’ businesses, but the greatest number of individual unicorns in ‘Internet Services’. Despite the ongoing hype, FinTechs are middle of the pack on both counts.

As with so many other patterns, the value of global unicorns has a long-tail, with a ‘winner-takes-all’ distribution of valuations: a very small number of the total unicorn herd has a significant amount of the overall value. Familiar Western names like Uber, Wework and SpaceX share the top positions with fast-moving Chinese giants, ByteDance and Didi Chuxing.

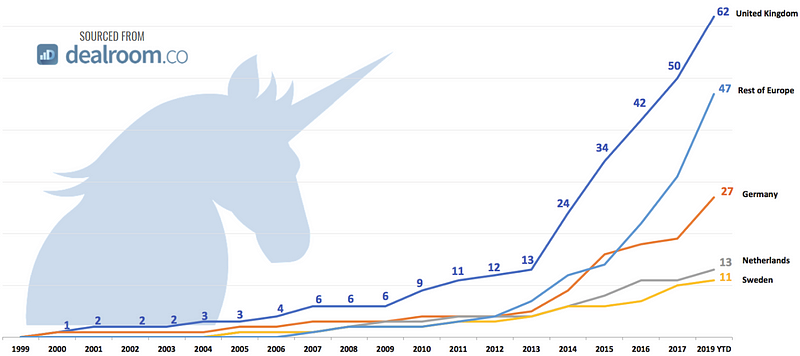

The story in Europe

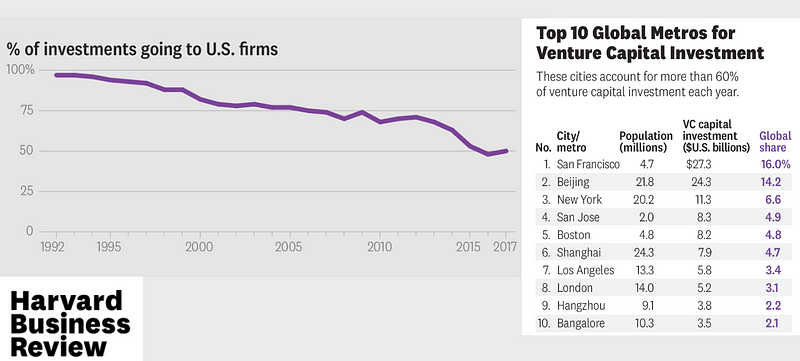

Venture capital investment continues to bleed out of the US, into Europe and the Far East. Harvard Business Review reports an that the US continues to erode its dominant position as the centre of the VC universe.

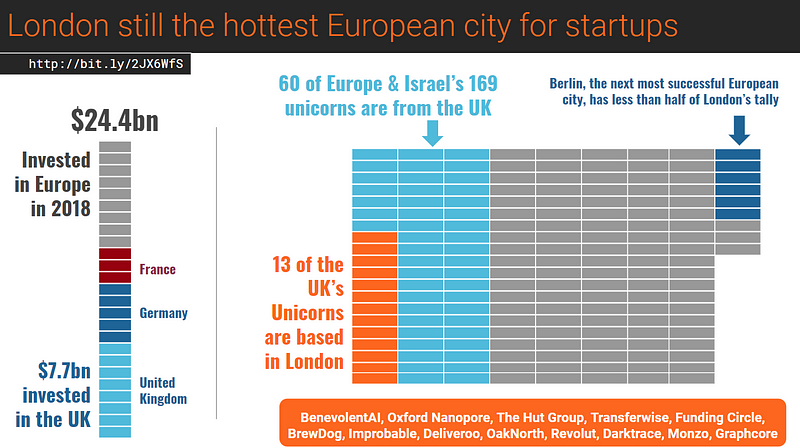

Europe, meanwhile, continues to make hay, with the UK — and London specifically — being a hotbed for unicorn sightings

So powerful is London in the European venture scene that it has produced 13 of Europe and Israel’s unicorns, more than double that of Berlin (the next most successful European city). The UK, with other fertile ground like Cambridge and Edinburgh, is home to 60 of the total 169 from the region. The UK also receives nearly $8bn of venture cash of the total $24bn going into Europe.

Cockney unicorns include fashionable FinTechs like Transferwise and Funding Circle, Monzo and Revolut.

London is a particular favourite for European FinTechs, which are following the overall venture investment trend of larger, but fewer, investments. This can perhaps be read as the market maturing (as it did in the early teens with mobile), where investors are no longer willing to spread their investments over a large number of risky bets, in favour of bigger bets on better known players.

How’s the Internet doing?

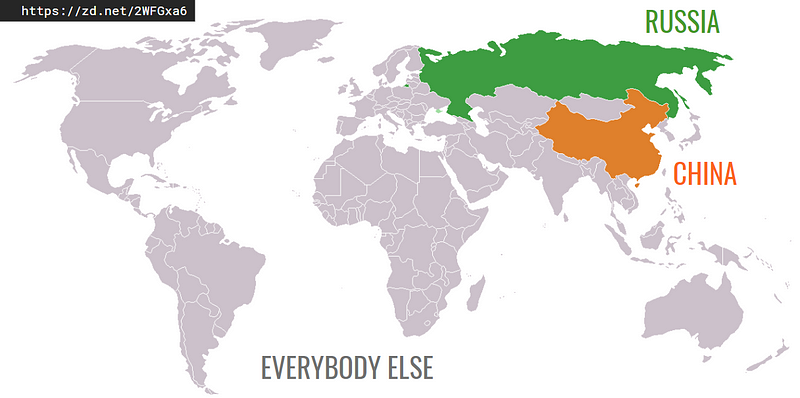

Not as well as could be hoped, with Sir Tim suggesting that it’s time that the stranglehold of the internet giants should be broken. It’s also now under a very real threat from Russia and China of becoming what has been termed the ‘splinternet’, with those countries taking an increasingly aggressive stance to decouple from the rest of the world (but, more of that later).

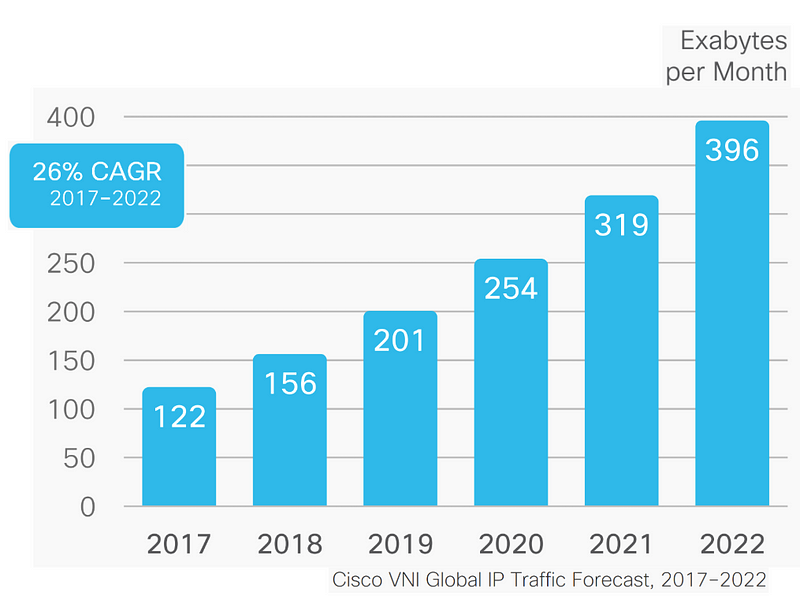

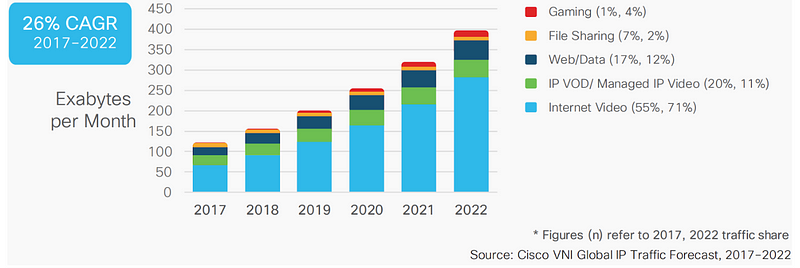

However, in other ways our old internet remains in rude health, with Cisco predicting ever increasing demand for bandwidth.

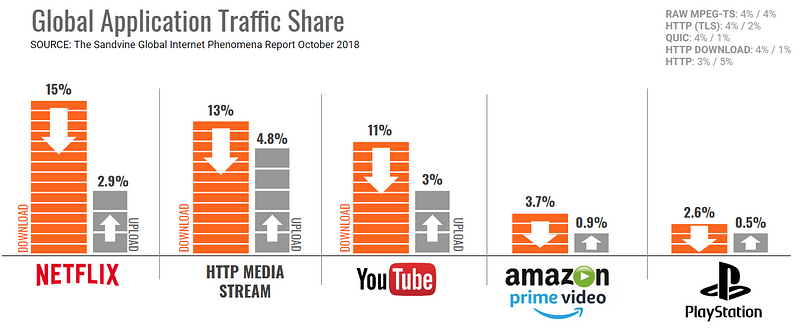

And, what’s driving the demand for all of this bandwidth? Why, the very same phenomenon that has been blamed for damaging the US birthrate:

That’s right, 15% of the global traffic share for applications belongs to… Netflix!

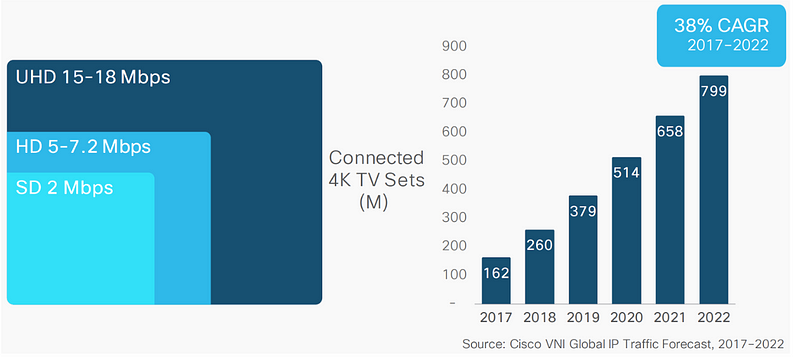

A significant part of the demand for bandwidth as we move into 2019/2020 is the growth of 4K/UHD streaming, which (as reported by Cisco) is massively more intensive than HD

And it’s streaming video, of all types, which leads the bandwidth hogs, with internet calling, web browsing and file sharing trailing by massive margins.

Social Media Trends

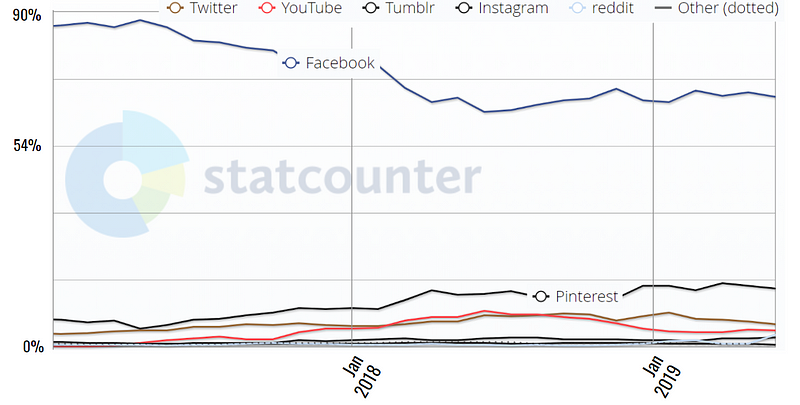

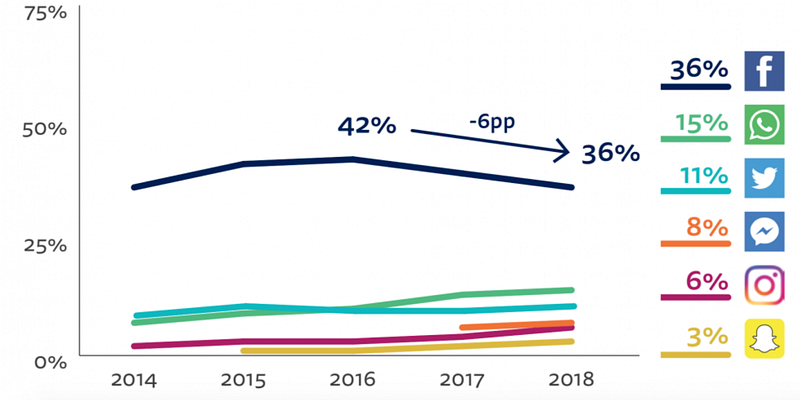

The social story of the year is tied between two strong contenders. Vying for position as the most disappointing performance of 2018 is Facebook, with continued erosion of its dominant position. Whether this is by ethical missteps, or simply a diminishing attractiveness to younger users is unclear but the answer is likely ‘both’.

Perhaps one benefit from the decline of Facebook is the number of people choosing to trust it as a source of news, as Nieman Lab reports:

And the other story fighting to displace Facebook as the most newsworthy? Why, this cheeky clone of Vine, of course.

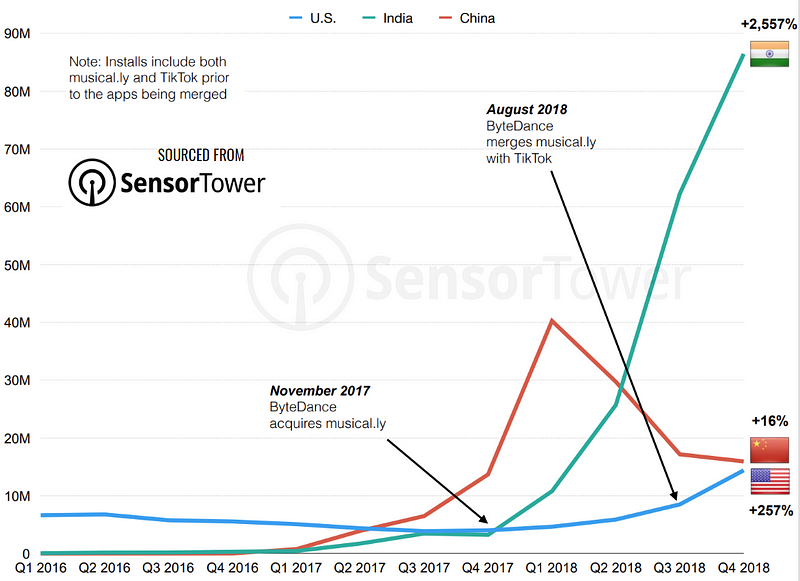

TikTok, a video sharing product from China’s ByteDance, was originally intended to share Karaoke-like videos but has grown at an breathtaking rate as it spread out of its home market. India, in particular has fallen for the app as the SensorTower data demonstrates.

TikTok was ranked number one in worldwide App Store downloads in 2018 with more than 650 million installs.

Outside of TikTok, it was sadlly time for Carter’s Nugs to be displaced as the most popular tweet of all time, with a post from Japanese billionaire, Yusaku Maezawa taking the crown.

Call me old fashioned, but offering a cash gift for your online store (ZozoTown in Maezawa’s case) isn’t quite as compelling as a call for help in achieving infinite nuggets. Carter is still my emotional winner.

For those paying attention to the scores, @Cristiano Ronaldo is still winning at Instagram and Facebook, with the greatest number of fans.

Streaming Video

We’ve already discussed the impact of Netflix on both the birthrate and bandwidth consumption, but the online streaming video market is going to get a massive shake-up in 2019. Netflix’s dominant position has only really been challenged by Amazon Prime to date (particularly outside the US), but 2019 will see a number of new challengers and a massive disruption to where shows are licensed for distribution.

The new market will retain Amazon and Netflix at the forefront, but has seen new additions from Apple, forthcoming entries from Warner Media and NBC Universal and the majority acquisition of Hulu by Disney.

The launch of the Disney streaming channel will see most Marvel properties move away from Netflix — I’m still smarting from the loss of Daredevil, Punisher et al — and a redistribution of licensed material from a confusing array of media owners and buyers. The chart below shows the most popular shows on Netflix and Hulu, with the content owner in brackets. As this demonstrates, conflict over which app shows which show is going to keep many lawyers in Hollywood well looked after.

Rather than offering more choice, this looks to only make things even worse for viewers who will potentially need to pick and choose subscriptions and juggle a portfolio of apps to stream to their device of choice.

It wouldn’t be an alternative round-up of the year if we didn’t also include some of Pornhub’s streaming stats. Pornhub themselves claimed that their 2018 visits figure rose to 33.5bn, an increase of 5 billion visits over 2017. 29 percent were female, an increase of 3 percent over the previous year. In weirder news, top searches for 2018 included Stormy Daniels (naturally) and Fortnite (uh), which eclipsed Overwatch as the site’s favorite video game. Pornhub matches global trends for mobile adoption, with 80% of traffic now from mobile devices.

Apps and Mobile

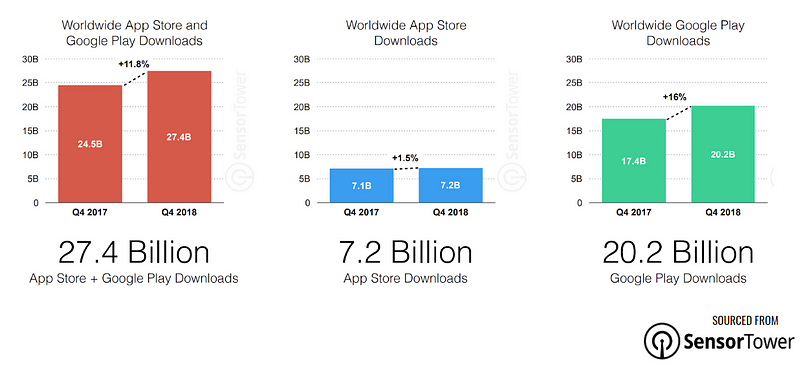

Speaking of mobile, SensorTower report continued growth of both App Store and Google Play downloads, beating previous records comfortably. Quarterly downloads for both platforms combined now exceeds 27bn, with Android taking over 20bn of that figure.

As always, while the downloads figure skews to Android, the amount spent in the store favours Apple equally strongly.

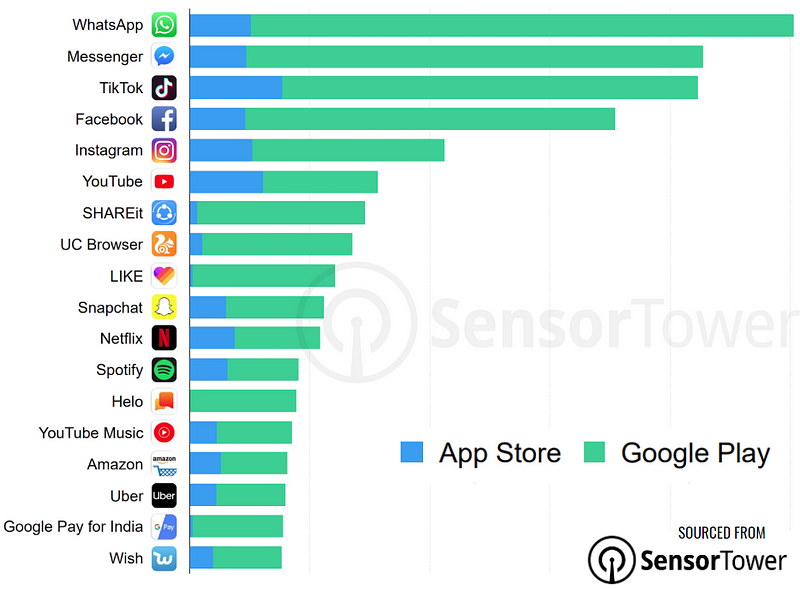

While TikTok is now comfortably the most popular iOS app, SensorTower report that WhatsApp maintains its hold on the Google Play (and overall) number of installs.

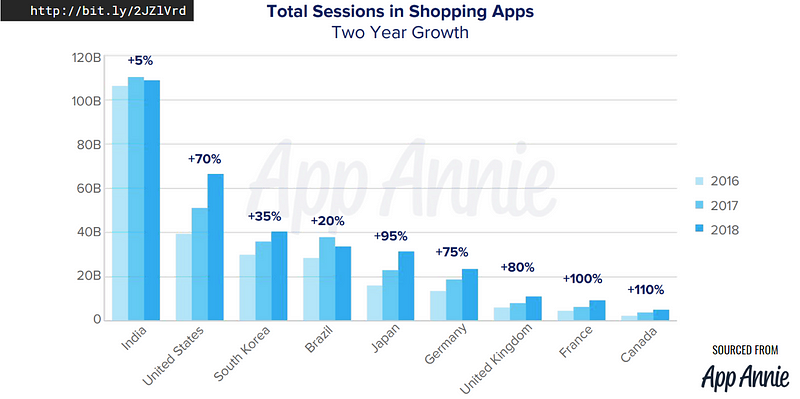

Over the same period, both App Annie and Sensor Tower report that the shopping apps continue to grow in both downloads and time spent in most countries (India bucks the trend slightly).

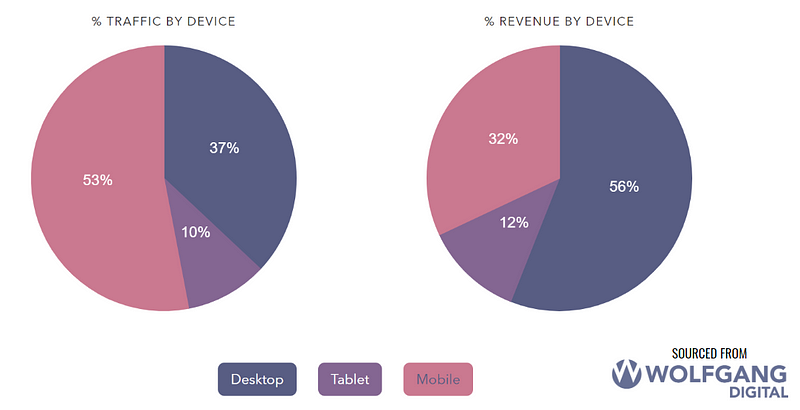

Despite the evidence that mobile is driving more traffic than ever to retail sites, it’s desktop that inevitably converts those browsers into shoppers.

Despite a comfortable margin (53% mobile vs 37% desktop) for total traffic, those stats turn on their head for revenue earned, with 56% of revenue attributed to desktop.

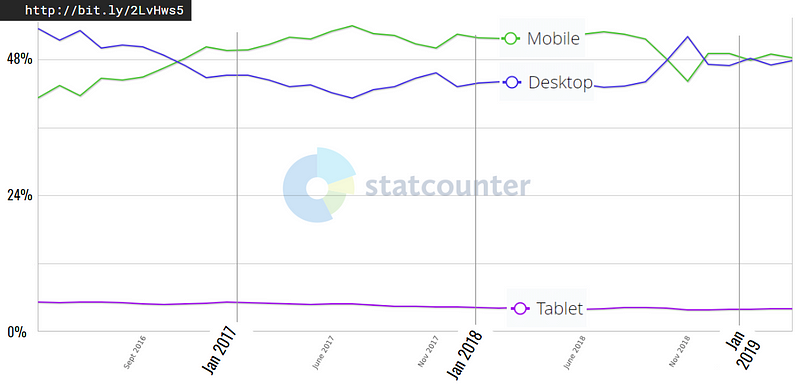

This highlights one more trend for the year, with Gartner reporting a 4% drop in PC shipments in Q1 19, and StatCounter showing the battle for mobile vs desktop supermacy to be neck and neck:

Gaming & eSports

Google uneqivocally declared gaming to be one of the ‘must watch’ sectors with its announcement of Stadia earlier this year. Once the domain of Sony, Nintendo and Microsoft, Google’s Stadia aims to stream 4K gaming directly into our homes using only a browser, allowing us to rid ourselves of our Xboxes and Playstations for good.

Many questions remain over the quality of this solution (especially the increasing digital divide between those living in fibre-connected city homes, versus those in rural settings with slower connections). Latency, in particular, will have a massive effect on the gaming experience.

Perhaps more importantly though, this news has upset the traditional Microsoft vs Sony tussle. Following the Stadia announcement, Microsoft announced a somewhat cagey partnership with Sony. Redmond also demonstrated an ever closer tie to Nintendo, integrating Xbox Live with the Japanese firm’s Switch console.

It will be interesting to watch how the ownership of flagship game titles changes in this new world. Is is a coincidence that Microsoft have acquired no less than six games studios since July 2018? It can’t be long before Amazon, with its AWS compute power, ownership of game streaming leviathan, Twitch and its mastery of retail will bringing it to the gaming table.

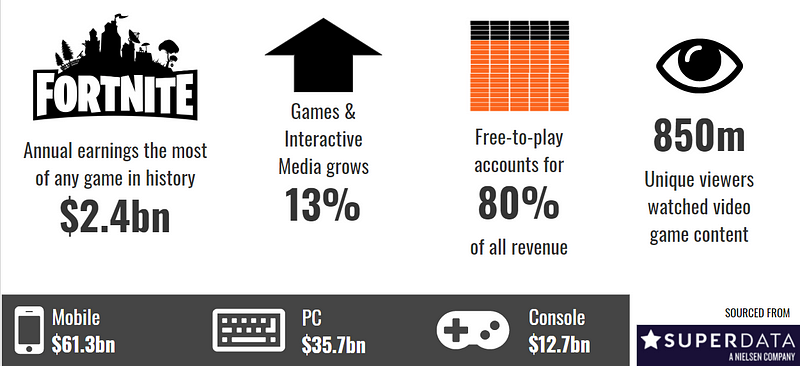

Why is this important? Well, cash. Gaming is now a near $100bn a year, industry, across mobile, PC and consoles.

And it’s not just playing games that is big news. Nearly 1bn people watched streaming video game content in 2018 according to Superdata. A significant number of those viewers will be watching casual gameplay, but the area of real interest is the growth in eSports.

Twitch streaming superstar, Ninja, revealed that he earned $7m of his total $10m paycheck in 2018 was from Twitch and Youtube views alone. As if that one outlier didn’t point to how serious streaming is, more people (127m) watched the 2018 Mid-Season Invitational for League of Legends than watched the Superbowl (94m).

Gaming and eSports is now categorically prime time — ask any parent what their teenagers are watching and it will inevitably be streaming games or TikTok.

Of course, when they’re not watching games, teenagers are playing them. As a mark of the deepening impact of video games, 10 teenagers in Gujarat, were detained by police for playing Player Unknown Battlegrounds (PUBG), breaking a ban put in place to combat ‘violent traits’.

Privacy & Security

In recent memory there’s never been a good year for security, and 2018 was particularly good at being bad. Facebook led the charge with the Cambridge Analytica outrage, but followed it up with a breach of 50m accounts revealed in September of last year.

Not to be outdone, it was discovered that Android phones featuring face recognition were susceptible to being fooled by 3D printed heads of their owners. Perhaps not a drive-by hacking, but certainly something that a determined attacker could implement.

Another Alphabet property, Nest, was also found to have a vulnerability to ‘credential stuffing’. Whilst not explicitly a security flaw in the Nest camera (although it should probably encourage two-factor authentication), the fact that owners often reused common passwords allowed drive-by hackers to access Nest cams, with sometimes horrifying results (like advertising PewDiePie).

This, perhaps, would be less of a problem if the internet wasn’t now awash with your old passwords. One aged treasure trove of 773m passwords has been collected over years, but is now being sold in one download for the low, low price of $45. These same credentials may have been just the right ones to hack into your otherwise safe Nest cam.

In more public threats to privacy, on to Taylor Swift. It was revealed in December that Swift’s team had employed facial recognition technology at her concerts. Ostensibly to screen for stalkers and other miscreants, screens outside her Rose Bowl concert venue were both displaying her performances, and recording audience faces to match against a database of Swift’s known stalkers.

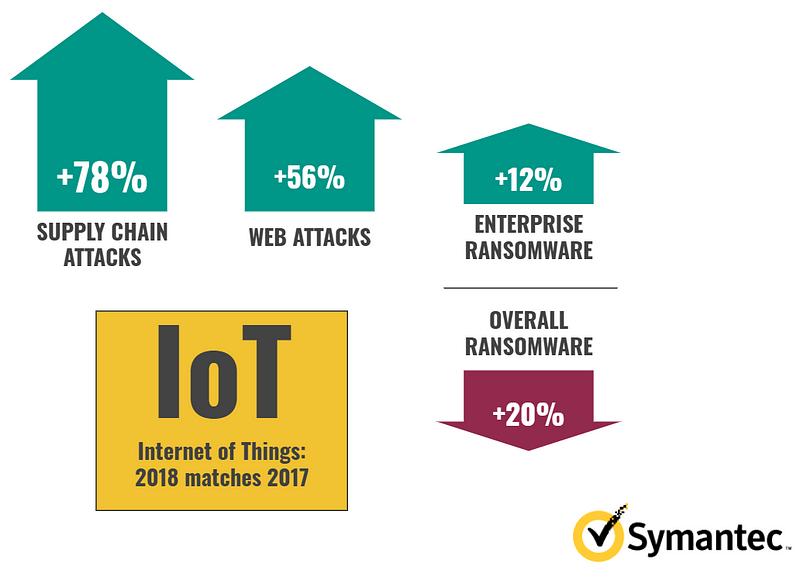

Symantec’s annual Internet Security Threat Report expressed the changing face of attacks against both domestic and business targets. 2017 was marked as a year of ransomware attacks, but 2018 saw an overall decrease (20%) in total ransomware attacks. While the overall decrease was positive, we also saw an increase of 12% in Enterprise (business-targeted) ransomware, and 33% increase in mobile ransomware.

The largest growth was seen in supply chain attacks (+76%) — again an attack targeted against businesses. This type of attack leverages suppliers weaknesses to access an end target. A popular route for this type of attack is via developers, often accessing source control repositories to escalate attacks.

Web attacks grew by 56%, with formjacking and malicious URLs responsible for consumer-focused attacks. Symantec found that 1 in 10 URLs visited by users protected with their software was malicious, an increase from 6% in 2017.

While domestic security risks are growing ever more pervasive, the most worrying threat of all to global security is no longer hackers motivated by mischief or money, but rather nation state disruption.

Access for users in mainland China to the Western internet is already carefully screened and connected via the ‘Great Firewall’, but matters have taken a more serious turn with Russia declaring their intention to separate Russian internet from the rest of the world by the end of the year.

The sovereign ‘Runet’ law is now set to come into effect in November 2019, at which time the balkanization of the Internet will be well on its way. The law is overtly intended to ‘maintain the stability of the Russian internet’ in case foreign aggressors try to interfere with Russian traffic.

Russian communications regulator Roskomnadzor will be able to direct traffic through Russian exchange points only, at times when the Runet is seen as being under threat.

Of course, writing from a Western perspective it’s hard to know the scale of the attack that Russian internet endpoints are under from the rest of the world (as it’s hardly something we’d encourage reporting on), however more evidence than ever is available that Western media is increasingly a plaything for Russian bad actors.

The interference in the 2016 US election and disruption of the UK Brexit vote made for obvious political targets, but the subtlety and pervasiveness of the manipulation is only now really starting to be understood.

Recent stories have started to surface on Western social media that were seeded on Russian news outlet RT America. The piece, titled “A Dangerous Experiment on Humanity” documents numerous health threats posed by the new 5G mobile telecoms standard, including this Hazmat clad worker installing 5G antennae on a radio tower.

Of course, there’s no real evidence that 5G is harmful, but growing evidence that the scale and scope of misinformation campaigns levelled at the West by Russia is intended to destabilise the population through totally unprotected channels. Facebook and Twitter, the primary means of dissemination of confusion, still seem entirely unprepared for the task they are facing down to control directed and persistent misuse.

Roskomnadzor is apparently three moves ahead in the cyber chess game being played out with US social media outlets as pawns.

In other news…

It seems churlish to leave you all on such a negative note, so I’ll include some other high points from this year’s full deck.

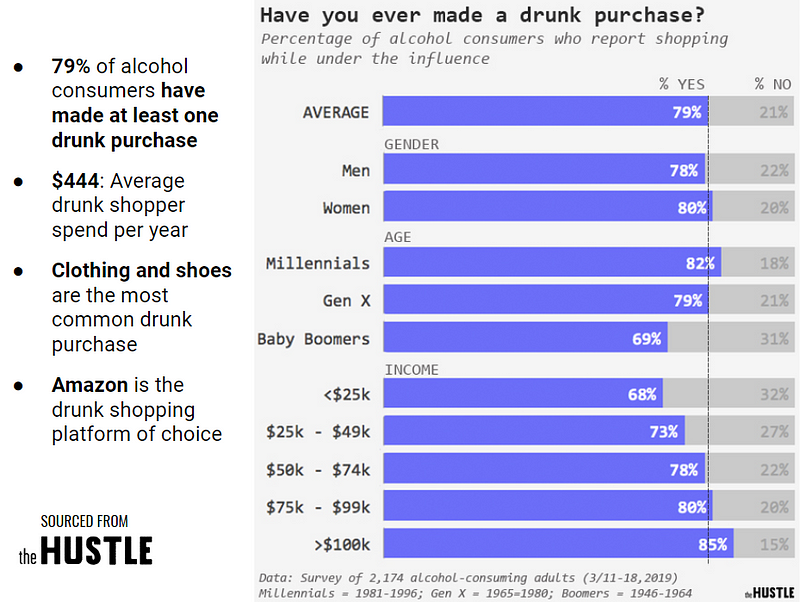

I thought I was the only one afflicted by this costly disease, but I’m pleased to be able to report that Drunk Shopping is officially a thing! The Hustle report I’m in good company, with 79% of people admitting the shop while drunk.

In important science news, for those folicly challenged out there, it seems that making your scalp ‘smell’ the sandalwood odorant, Sandalore, can cure baldness.

Finally, and in perhaps the best marsupial news of the year, scientists have uncovered how the wombat can produce its unusually cuboid faeces. Apparently, the intestine itself doesn’t stretch in a consistent way, but rather with four stretch faces, and four stiff regions. This discovery could be important for such future innovations as cubic sausages.

And there you have it — a marsupial shaped treat to reward your patience. There’s still much content (drones, robots, AI, cyborgs, quantum computing, cryptocurrencies and more) that I’ve omitted for brevity and to ensure I still have something for those that come to see the deck in person.

Thanks for your patience and remember: don’t reuse your password or feed the trolls.