One of the things that I hear repeated, and believed myself for many years, was that contractors or outsourced agencies are much more expensive than permanent employees. Whilst that can often be true, it’s not quite as simple as most people think.

In the past, when I tried to understand the ‘real’ costs of my engineering teams I knew that I needed to factor more than their just their basic salary into my budgets. For an employer, there are a myriad of additional costs that make up the real cost of an employee that can be opaque even if you’re directly responsible for the budget. These extra costs are known as ‘oncosts’, or “the additional costs that need to be taken into account, in addition to salary, to budget the full employment costs of a new post or existing staff member”.

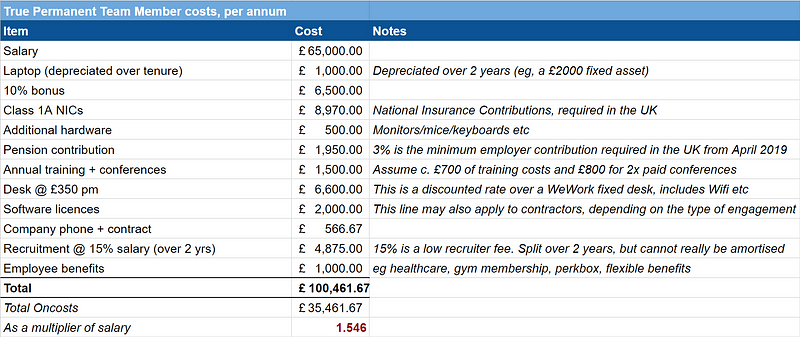

Let’s have a look at the real cost of employing a great developer, Alex, who earns a basic salary of £65,000 a year. Alex works for an averagely good company called Average Plc that is mature enough to pay her a bonus, buy her a decent company laptop, send her to a couple of conferences a year and buy her a Pluralsight licence (because all developers should get a Pluralsight licence).

This is what Alex’s total, average developer package looks like in the UK (YMMV for your region).

The spreadsheet above is available via Google Sheets here

As it happens this 1.5x factor is exactly the number that I had agreed with a talented Finance Director many years ago. For years, this was my rule of thumb when I was doing quick mental arithmetic on staff cost forecasting: the real annual cost of a £65k per year role is close to £99k of cash leaving the business.

Whilst that 1.5x figure is correct for budgeting and a useful tool when you want to calculate staff costs quickly, it’s not the right way to compare permanent employees vs outsourced talent. You see, there’s a critical difference that’s missing from this calculation; the effective day rate for the resource.

You pay a permanent member of staff for a year, effectively receiving their benefit over the number of work days in the year. Our developer, Alex, gets to have holidays, go to conferences, have some sick days and other absence where she’s not actively generating value in the business. She deserves all of those things, of course, but from a financial point of view this is an important consideration when comparing the cost of permanent resources with outsourced talent; you only pay an outsourced resource for the days they are actively creating value.

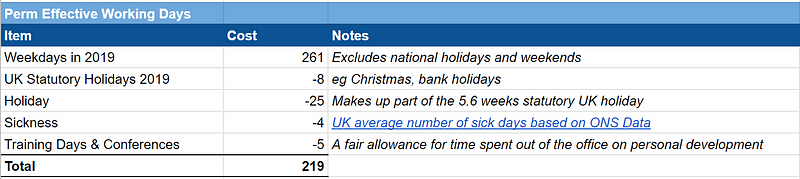

Let’s calculate how many days Alex is actually working in the business

Here’s the number of working days for a typical British employee; there are 261 weekdays in 2019, with 8 statutory holidays (like Christmas and our charmingly named Bank Holidays). Most businesses allow 20-25 days of holiday, and the average number of sick days taken by a British employee is 3.6. We’ll also want Alex to be benefiting from personal development, so we’ll add a couple of days for internal and external training and two days for conferences.

That means that Alex is effectively being a valuable developer a nice, average, 219 days a year which leads to our final calculation — what is Alex’s comparative day rate if she was charging us as a contractor?

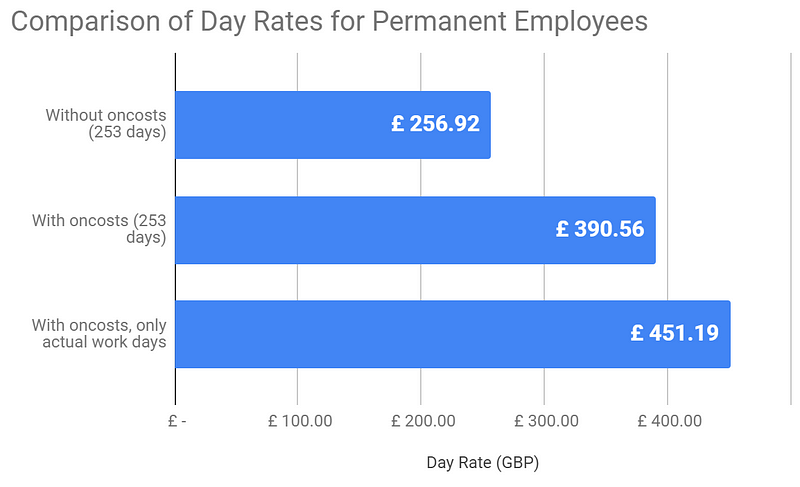

If we naively calculate based on the 253 working days in the year, Alex’s £65k per year basic salary looks like it’s only £257 per day. If we take Alex’s real £99k cost to the business, it shoots up to £390 per day.

If we then do our final calculation and look at Alex’s real cost and take into account the 219 days she is actually delivering code, we see that her cost as a contractor day rate would actually be £451.

Suddenly, that outsourced developer rate doesn’t look quite as expensive in comparison.

The pros and cons of using contractors

This example is specifically aimed at the correctly validating the cost of permanent staff versus using outsourced labour, especially in short term engagements where expertise is brought in to support existing teams for a few months*.

To be clear, I have a strong personal preference for building my own teams with permanent staff, but the reasons are primarily long term; building a team, greater motivation, lower overall cost and a real desire to be developing junior team members.

There are many great reasons to justify both permanent and external expertise, but hopefully you’ll now have a little more data for your calculations: use (1.5 x base salary) for budgeting permanent employees with oncosts, but for comparing perm costs to outsource rates you can use the handy James Bond shorthand of (0.007 x base salary) for day rates.

* * There are many complexities related to paying contractors directly (who start to accumulate benefits from their employers under UK law the longer that they work from them), so this model is more appropriate when considering resources supplied by another business.

* * * With thanks to Howard Van Rooijen from Endjin for pointing out changes to the UK’s statutory pension rates from April 2019

This article is written with UK data and employment law in mind. I’d be grateful to hear from any readers who would like to help translate the economics of the article for other regions.